Retirement Financial Adviser & Founder

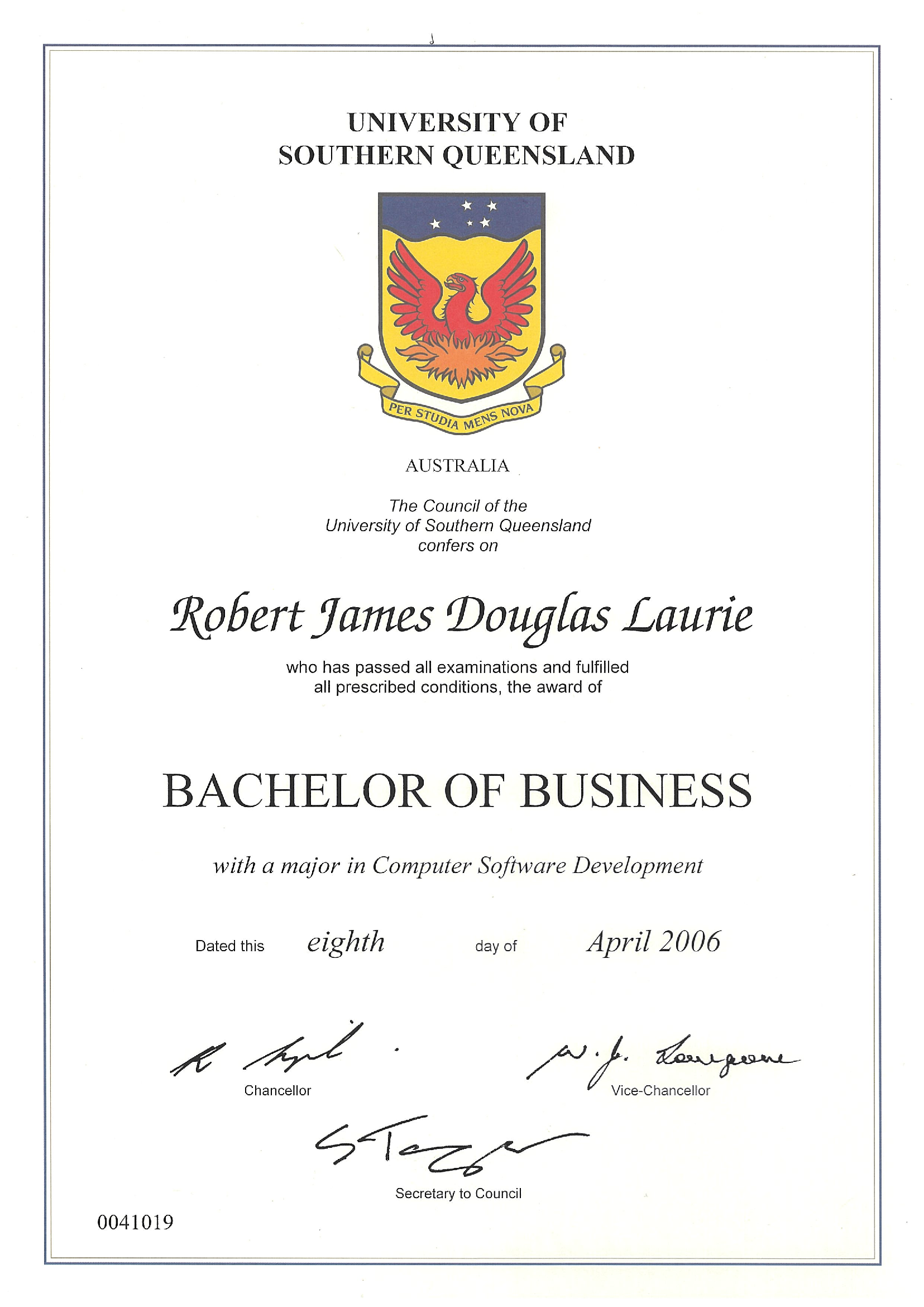

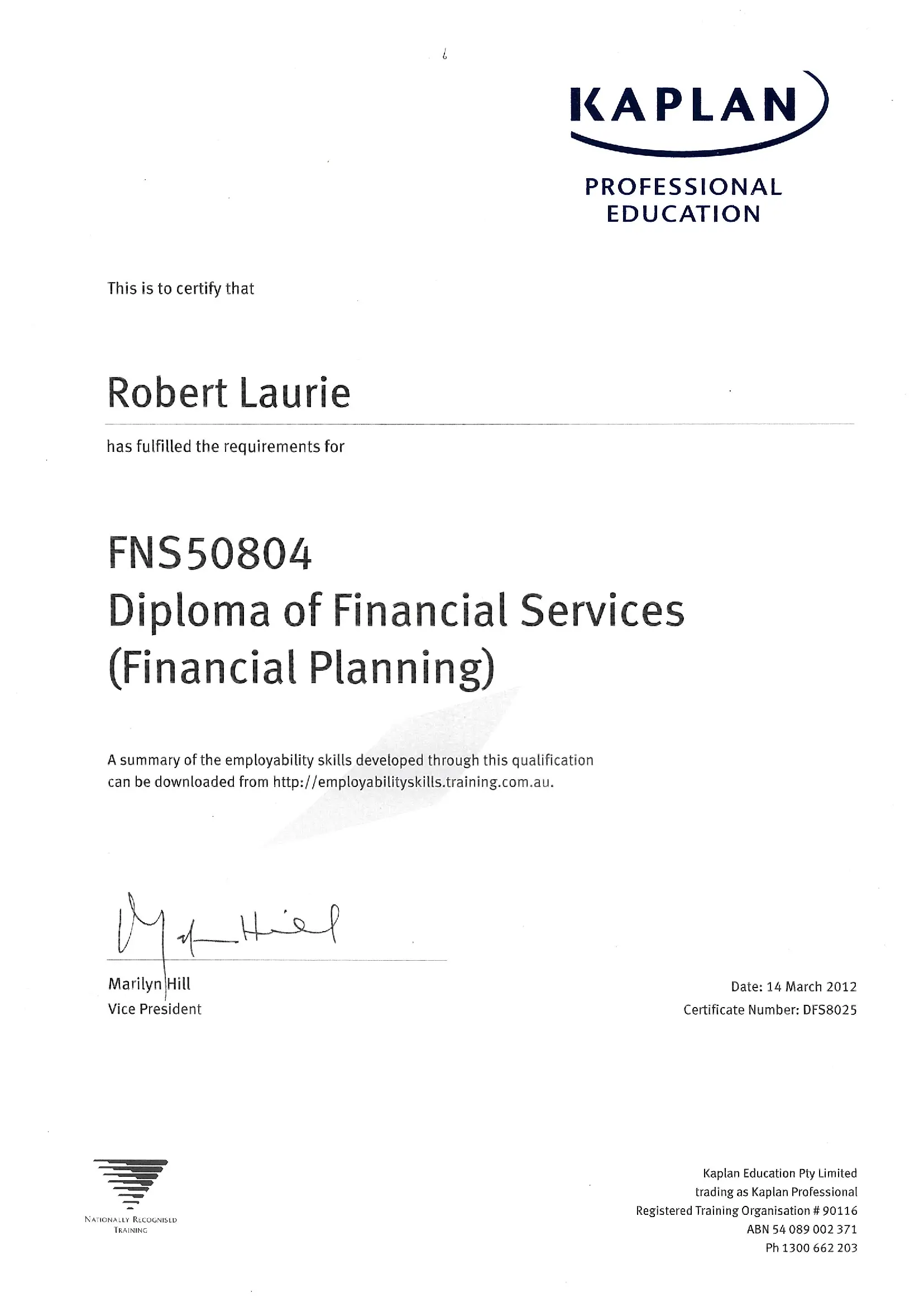

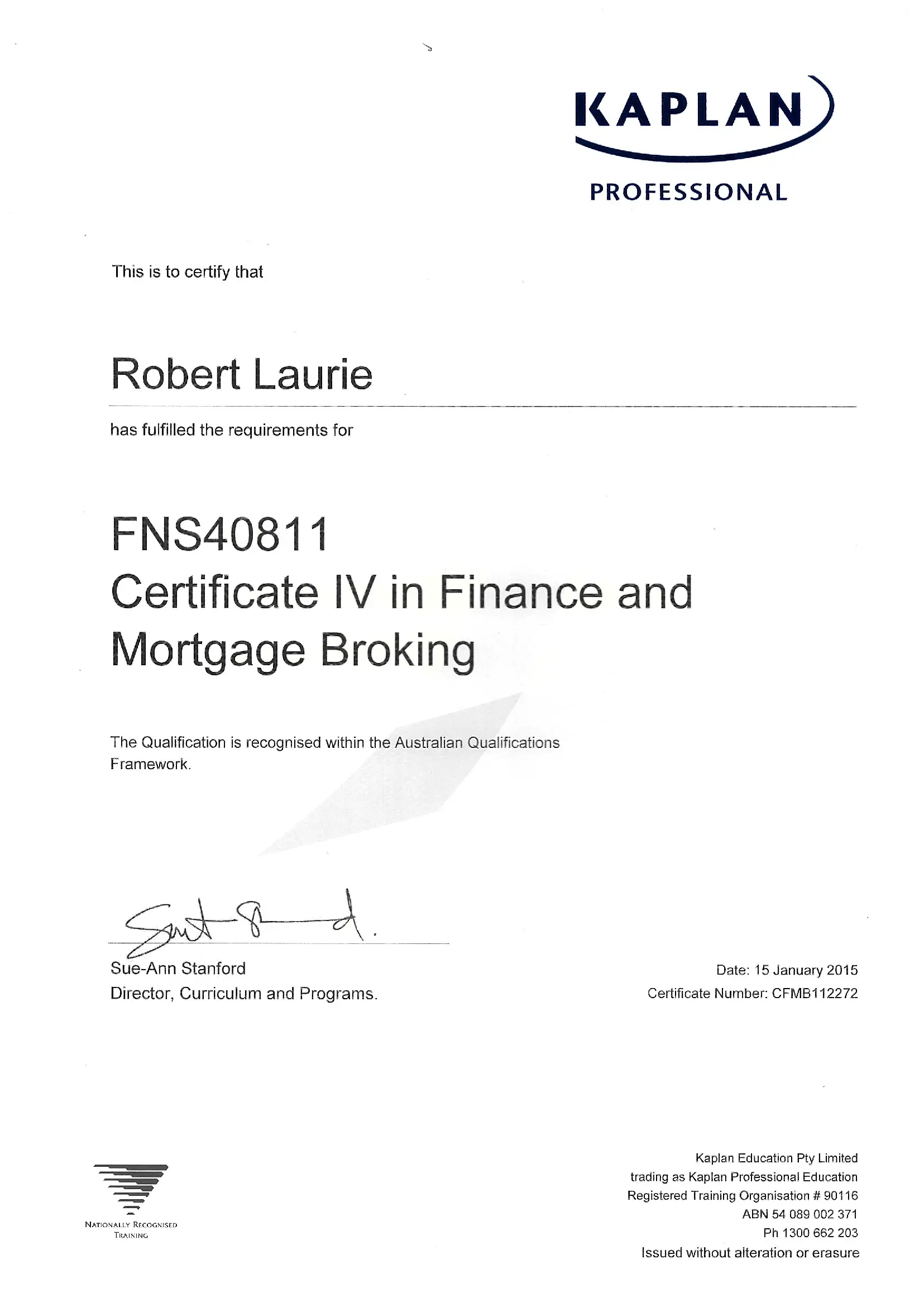

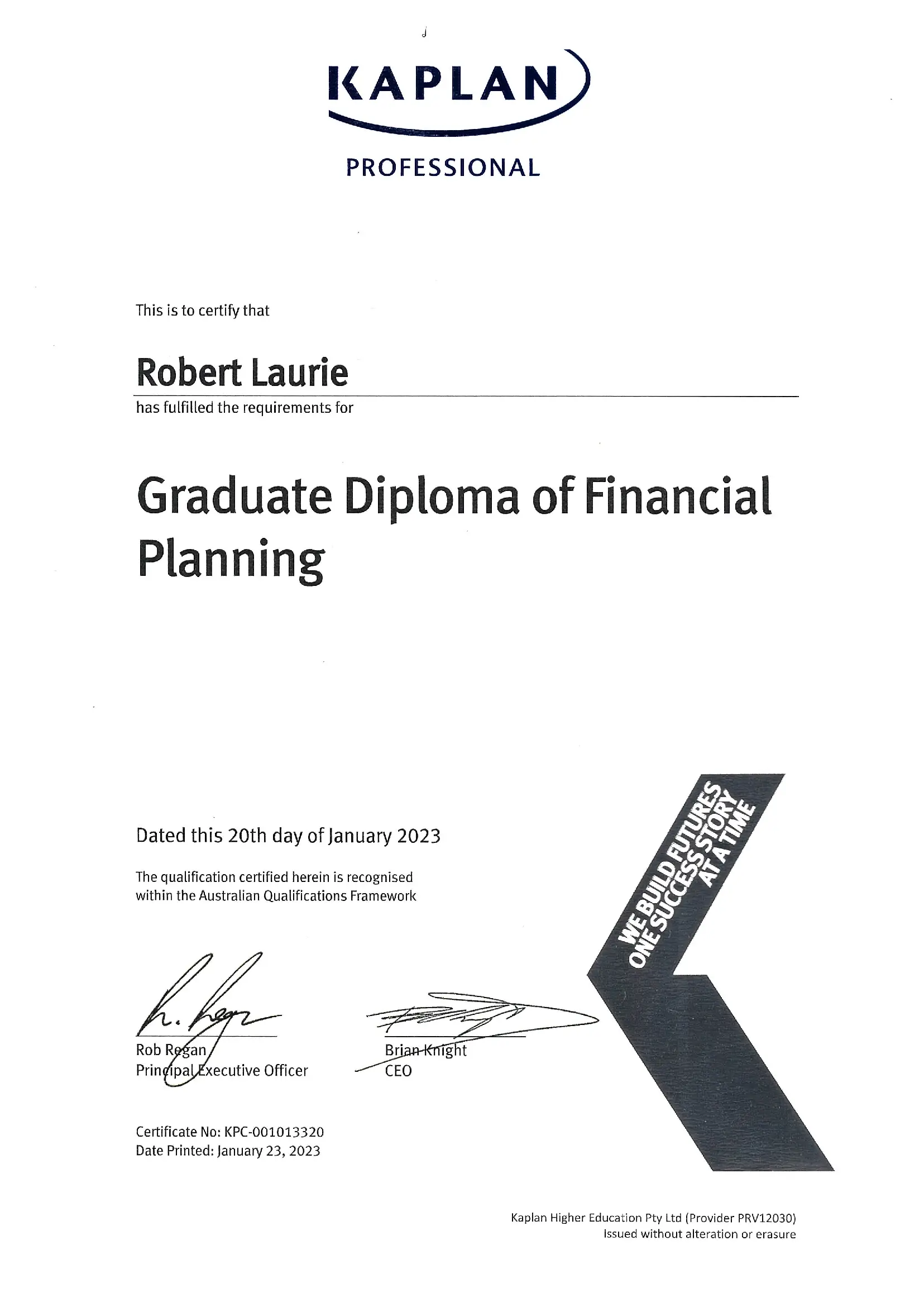

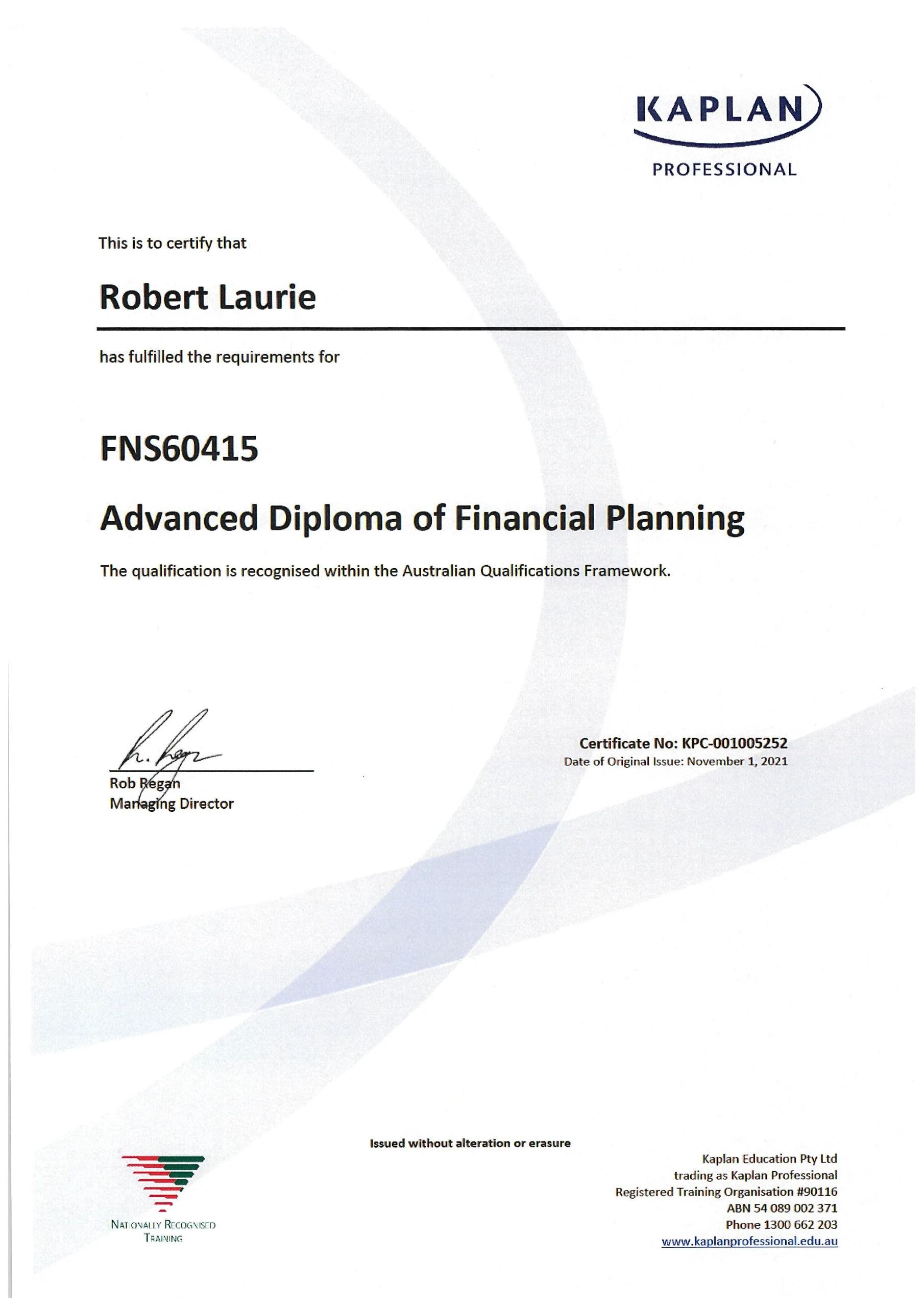

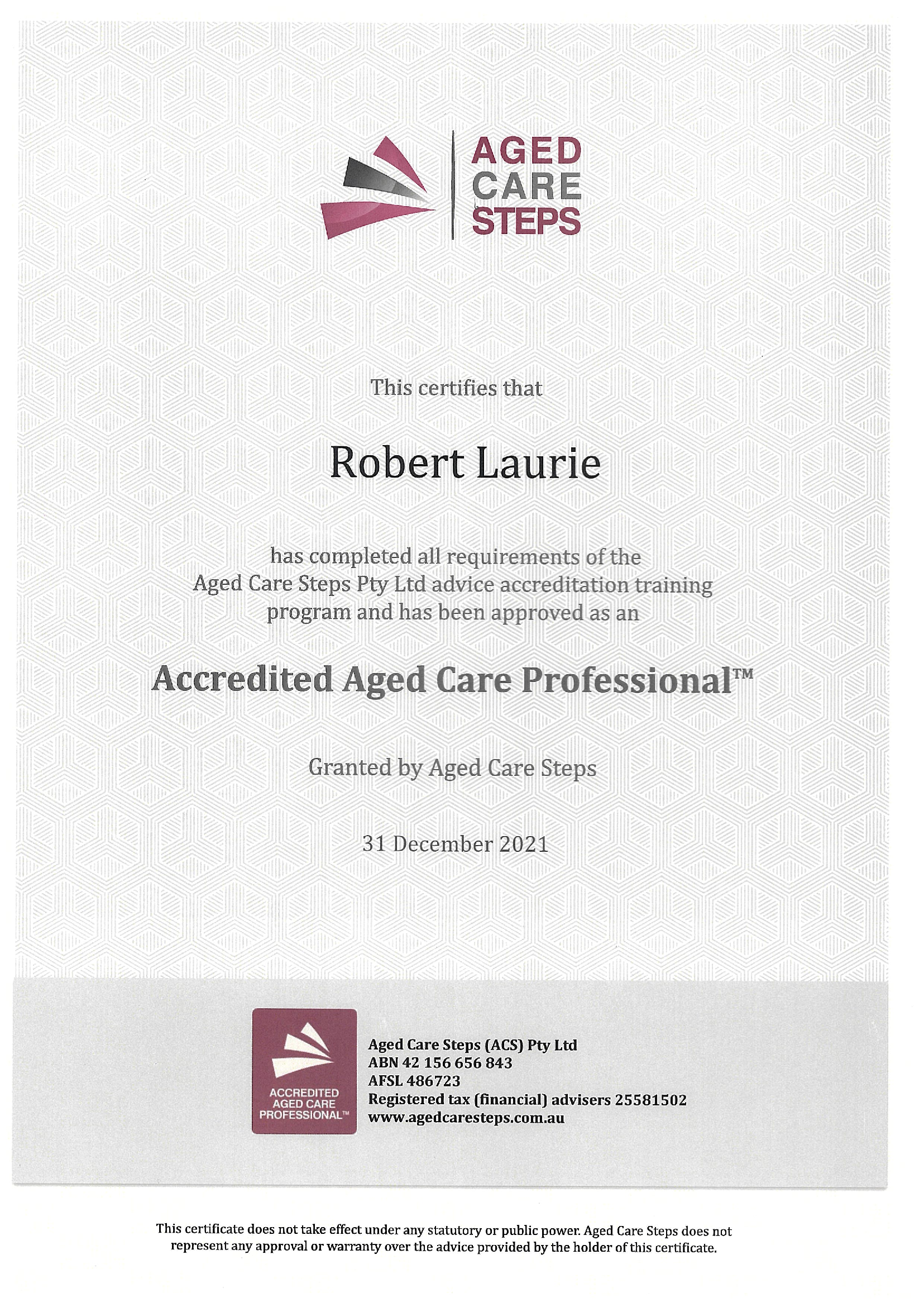

Rob embarked on his journey in the financial services profession back in 2006, driven by his desire to assist individuals in safeguarding what mattered most to them. However, as he delved deeper into his clients’ financial affairs, he felt compelled to provide more comprehensive assistance, leading him to transition into the realm of holistic financial advice. Equipped with a Bachelor of Business from the University of Southern Queensland, where he majored in Computer Software Design and minored in Business Management, Rob seamlessly merges his technical expertise with a profound understanding of his clients’ unique needs.

Rob’s unwavering passion lies in helping his clients achieve their ideal retirement, a fact that becomes abundantly clear through his personalized strategies and meticulous attention to detail. He masterfully balances the ever-changing landscape of investment markets, skillfully manages cash flow, and navigates the intricate web of government legislation to ensure that your financial plans remain harmoniously aligned with your long-term goals.

As an esteemed member of the Association of Independently Owned Financial Professionals (AIOFP), Rob remains at the forefront of industry trends and stays updated on crucial legal developments. He steadfastly upholds the highest standards of professional conduct as defined by the AIOFP Code of Ethics and Standards of Professional Practice. Moreover, Rob has wholeheartedly embraced the Banking & Finance Oath, signifying his unwavering commitment to meeting the needs of the community and upholding the trust that has been placed in him.

Our Commitment to Personalised Retirement Planning

Rob Laurie demonstrates a strong commitment to personalised retirement planning by tailoring their approach to each individual’s unique needs, goals, and circumstances. He understands that retirement planning is not a one-size-fits-all process and recognize the importance of customizing strategies to meet specific requirements.

Individualised Assessments

The adviser conducts thorough assessments of each client’s financial situation, including income, expenses, assets, liabilities, and risk tolerance. By gaining a comprehensive understanding of the client’s specific circumstances, they can provide tailored recommendations and strategies.

Goal-Oriented Approach

Rob Laurie takes the time to understand the client’s retirement goals and aspirations. Whether the client aims to travel the world, start a business, or simply maintain a comfortable lifestyle, he incorporates these goals into the retirement planning process. He works closely with the client to establish realistic objectives and develop strategies to achieve them.

Customised Investment Strategies

Recognising that investment preferences and risk tolerances vary, the adviser creates personalised investment portfolios that align with each client’s unique needs. They consider factors such as time horizon, risk appetite, and financial goals to construct portfolios that optimise returns while managing risk effectively.

Regular Portfolio Review

The adviser is committed to regularly reviewing and adjusting investment portfolios based on changing market conditions, financial goals, and individual circumstances. This proactive approach ensures that the client’s retirement plan remains aligned with their evolving needs and helps optimize investment performance over time.

Benefits of Online Retirement Financial Planning

In addition to their commitment to personalized retirement planning, the adviser’s online approach offers several benefits:

Accessibility and Convenience

By providing retirement planning services online, Rob Laurie enables clients to access their expertise from anywhere at any time. Clients can seek advice, review their retirement plans, and make adjustments without the need for in-person meetings or lengthy office visits.

Efficient Communication

The online approach facilitates smooth and efficient communication between Rob Laurie and the client. They can connect through video calls, emails, or secure online portals, ensuring timely responses to queries and concerns.

Enhanced Security and Privacy

Rob Laurie prioritises data security and privacy, employing robust encryption and secure platforms to protect clients’ sensitive information. Online systems often have multiple layers of security measures to ensure confidentiality and peace of mind.